Money Laundering Scheme Definition

The concept of money laundering is essential to be understood for those working in the monetary sector. It is a course of by which dirty money is transformed into clean money. The sources of the money in actual are criminal and the money is invested in a means that makes it seem like clear money and conceal the identification of the criminal part of the cash earned.

Whereas executing the monetary transactions and establishing relationship with the brand new prospects or maintaining existing customers the responsibility of adopting sufficient measures lie on every one who is a part of the organization. The identification of such component in the beginning is easy to cope with as a substitute realizing and encountering such conditions in a while within the transaction stage. The central financial institution in any country provides full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously present enough safety to the banks to deter such conditions.

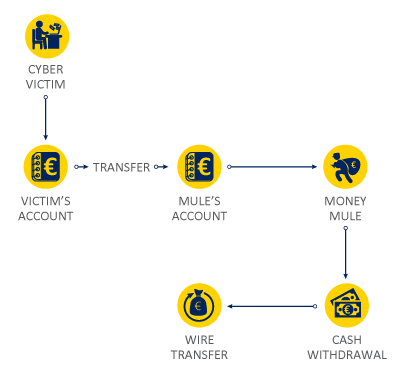

Criminals make the proceeds of crime appear to be legitimate in order to get away with their crime without raising suspicion. A money mule also known as a smurfer is an individual that is recruited knowingly or unknowingly to act on the behalf of criminals as part of a money laundering scheme.

Money Laundering Crime Areas Europol

Money laundering tools and techniques.

Money laundering scheme definition. 3 Stages of Money Laundering Placement ie. The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to.

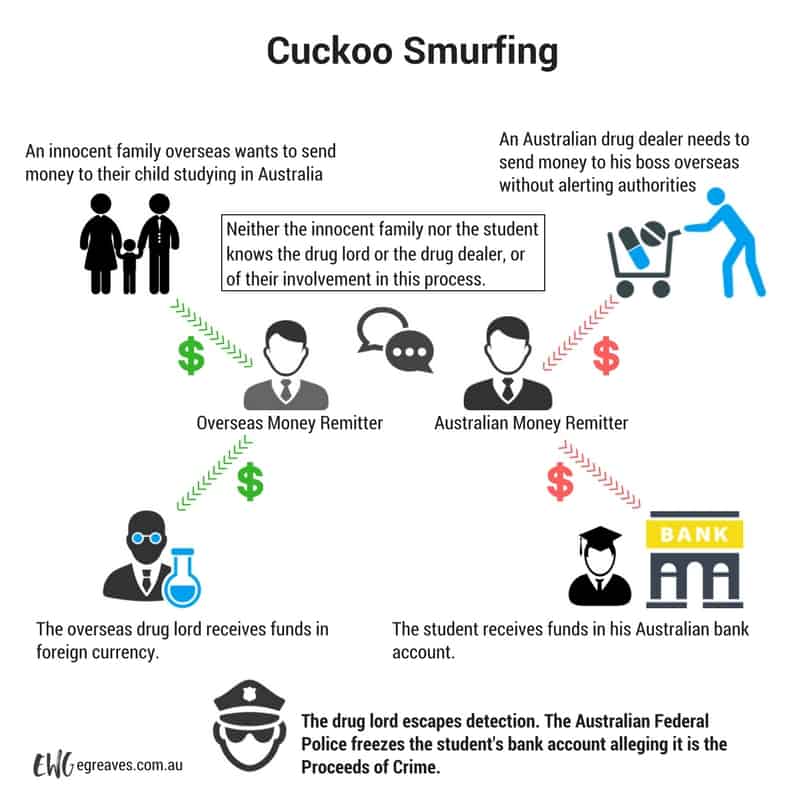

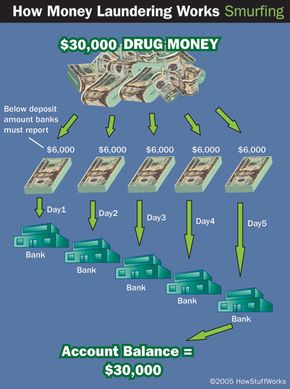

Companies that engage in a Ponzi scheme focus all of their energy into attracting new. This technique involves the use of many individuals thesmurfs who exchange illicit funds in smaller less conspicuous amounts for highly liquid items such as traveller cheques bank drafts or deposited directly into savings accounts. The laundering is done with the intention of making it seem that the proceeds have come from a.

A Ponzi scheme is an investment fraud in which clients are promised a large profit at little to no risk. It is a key operation of the underground economy. It is a crime in many jurisdictions with varying definitions.

While money mules may historically have been used to transfer physical amounts of cash between locations in a modern financial context they are generally used to open and manage bank accounts in order to. Moving the funds from direct association with the crime. The reasoning behind this is due to the fact that banks must report large or suspicious transactions to the IRS.

Money laundering is a federal crime in which large sums of dirty currency earned from illegal activity such as drug or sex crimes is cleaned and deposited into a legally sanctioned banking institutions. And this money is shown as legal money. Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct.

Money laundering is the act of placing illegal gains into the legitimate financial system in ways that avoid drawing the attention of banks financial institutions or law enforcement agencies writes McCoy in USA Today. The process works best when the cash is shifted through a series of other entities in multiple countries thereby making it more difficult to ascertain its origins. Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct.

It become money laundering when and if the original source was a crime - such as drugs frauds tax evasion bribery. Money laundering is a process which typically follows three stages to finally release laundered funds into the legal financial system. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income.

Money Laundering Definition Money Laundering is the process used to disguise the source of funds or money derived from criminal activities such as smuggling drug trafficking extortion corruption terrorist activities etc in order to make them appear as derived from a legitimate source. Global markets consider money. Mafia groups have made huge amounts of extortion gambling etc.

In other words it is simply process of converting dirty money into clean money. Laundering money is moving money in such a way that the sole economic purpose of the movement is to avoid ever knowing the real source of the money. Money laundering involves the use of processes to disguise an original source of funds or assets that are generated through criminal activities such as drug trafficking fraud smuggling corruption or extortion.

However the report specifically focuses on some of the common mechanisms used to launder funds such as trade-based money laundering account settlement mechanism and underground banking. The basic concept behind money laundering schemes is to shift illegally-obtained cash into a different entity usually in another country and then convert it into legal assets. The term money laundering originated from the Mafia group in the United States of America.

Money laundering is the term used to describe the act of taking illegal money from source A and making it look like it came from source B a legitimate legal source. General process of money laundering Money laundering is the process of changing large amounts of money obtained from crimes such as drug trafficking into origination from a legitimate source.

Understanding Money Laundering European Institute Of Management And Finance

How Money Laundering Works Howstuffworks

Understanding The Risks Of Money Laundering In Sri Lanka Daily Ft

Cuckoo Smurfing Explaining A Money Laundering Methodology

What Is Money Laundering Three Methods Or Stages In Money Laundering

What Is Money Laundering And How Is It Done

Tanzania Financial Intelligence Unit Money Laundering Definition Kitengo Cha Kudhibiti Fedha Haramu Maana Ya Biashara Ya Fedha Haramu

Understanding The Risks Of Money Laundering In Sri Lanka The Lakshman Kadirgamar Institute

What Is Anti Money Laundering Aml Anti Money Laundering

Money Laundering Terrorist Financing Are You Aware Anti Money Laundering Compliance Unit

How Money Laundering Works Howstuffworks

The world of laws can seem like a bowl of alphabet soup at times. US cash laundering laws are no exception. Now we have compiled an inventory of the top ten money laundering acronyms and their definitions. TMP Risk is consulting firm centered on protecting financial providers by reducing threat, fraud and losses. We now have big financial institution expertise in operational and regulatory threat. We have now a strong background in program management, regulatory and operational threat in addition to Lean Six Sigma and Enterprise Course of Outsourcing.

Thus money laundering brings many adverse consequences to the organization as a result of risks it presents. It will increase the chance of major dangers and the opportunity cost of the financial institution and ultimately causes the financial institution to face losses.

Comments

Post a Comment